As we step into the new year, it's essential to reflect on the significant developments in interest rates during 2024 and anticipate the trends that will shape the financial landscape in 2025. The past year has been marked by considerable fluctuations in interest rates, influenced by a combination of economic factors, geopolitical events, and central bank policies. In this article, we will delve into the key interest rate updates of 2024, analyze their implications, and provide an outlook for what we can expect in 2025.

2024 Review: A Year of Monetary Policy Adjustments

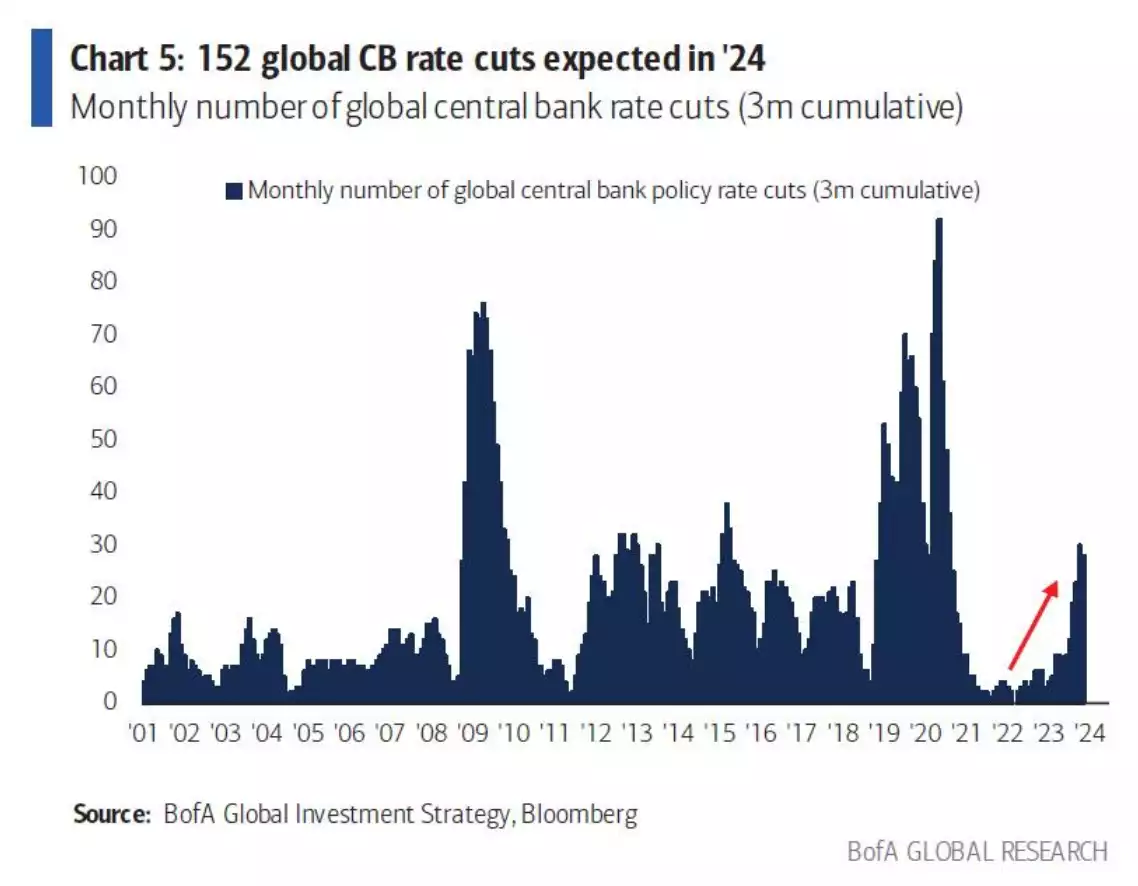

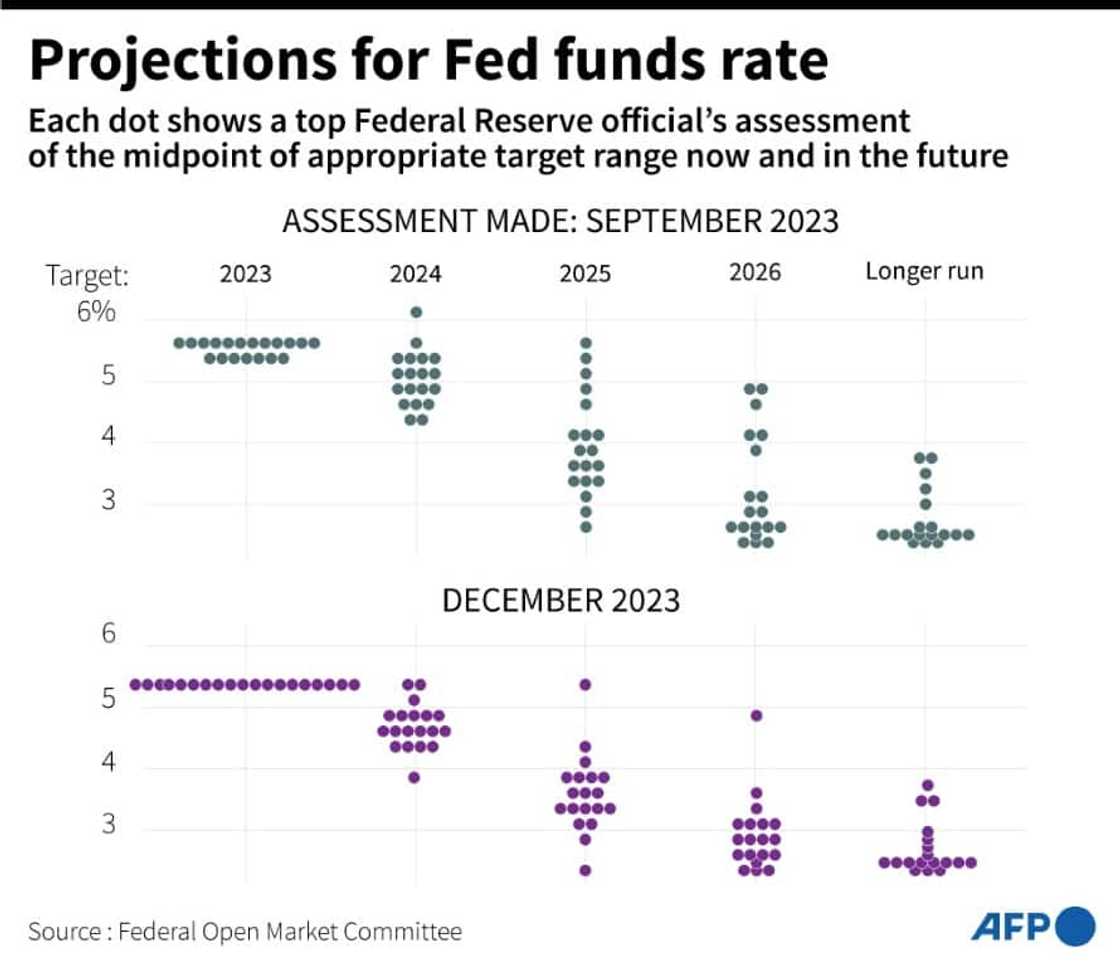

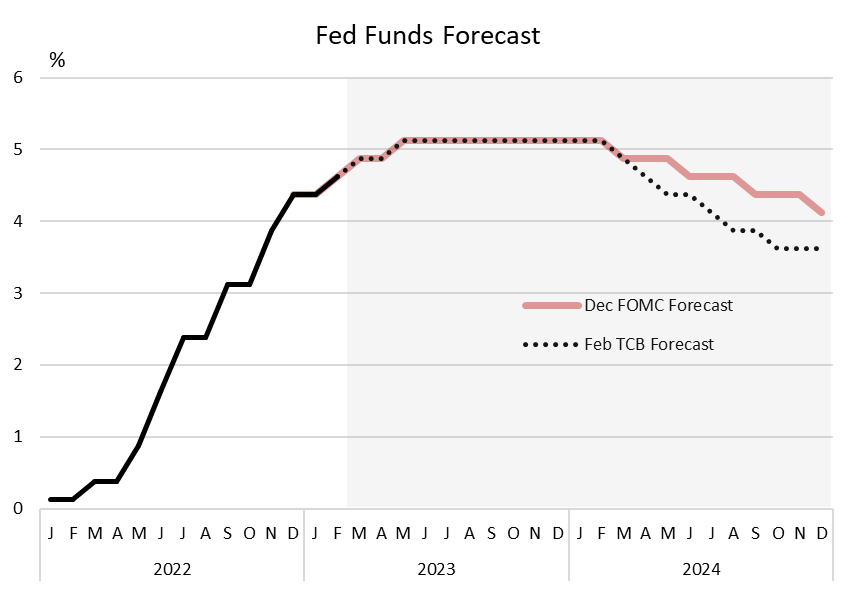

The year 2024 witnessed a series of interest rate adjustments by central banks worldwide, aiming to balance inflation control with economic growth. The initial months saw a tightening of monetary policies, with rate hikes intended to curb rising inflation. However, as the year progressed, concerns over economic slowdown and geopolitical tensions led to a shift towards more accommodative policies, including rate cuts in some regions.

-

Inflation Concerns: The start of 2024 was dominated by efforts to combat inflation, which had reached multi-year highs in many countries. Central banks, such as the Federal Reserve in the United States, employed aggressive rate hikes to reduce demand and bring inflation back within target ranges.

-

Economic Slowdown: As the year advanced, signs of an economic slowdown began to emerge, prompting a reevaluation of monetary policies. The pace of rate hikes slowed, and in some cases, rates were lowered to stimulate economic activity.

-

Geopolitical Factors: Geopolitical tensions and trade uncertainties also played a significant role in shaping interest rate decisions. These factors introduced volatility into financial markets, influencing investor sentiment and central bank actions.

2025 Outlook: Expectations and Uncertainties

Looking ahead to 2025, the outlook for interest rates is complex, with several factors set to influence monetary policy decisions. While inflation is expected to remain a concern, the pace of economic growth, geopolitical developments, and the response of financial markets will also play crucial roles.

-

Inflation Management: Central banks will continue to prioritize inflation management, but the approach may become more nuanced, with a focus on sustainable economic growth alongside price stability.

-

Economic Growth: The trajectory of economic growth will be a key determinant of interest rate policies in 2025. A slowdown could prompt more rate cuts, while a resurgence in growth might lead to a return of rate hikes.

-

Market Volatility: Financial market volatility, driven by geopolitical events, trade policies, and investor sentiment, will remain a significant factor influencing interest rate decisions and economic stability.

The landscape of interest rates in 2024 was characterized by significant adjustments in response to economic and geopolitical challenges. As we enter 2025, the path forward for interest rates remains uncertain, dependent on a delicate balance of factors including inflation, economic growth, and market stability. For investors, businesses, and individuals, understanding these trends and their implications will be crucial for making informed financial decisions. Whether you're planning investments, managing debt, or simply seeking to navigate the complexities of personal finance, staying abreast of interest rate updates and their broader economic context will be essential in the year ahead.

For the latest insights and analysis on interest rates and economic trends, subscribe to our newsletter or follow us on social media to stay updated.